35+ Current conventional mortgage rates

Apply Easily And Get Pre Approved In 24hrs. Current Mortgage Rates Comparison On July 12 2019 according to Bankrates latest survey of the nations largest mortgage lenders the benchmark 30-year fixed mortgage rate is 381.

2

Best for rate transparency.

. Now is the Time to Take Action and Lock your Rate. In fact rates dropped in 2019. Because last weeks rates were very closer to 2 month highs at the time it only took modestly higher rate for today to officially hit 2-month highs.

Trusted by 1000000 Users. Todays national mortgage rate trends. Quick Mortgage Lender Reviews 2022.

How Much You Can Save. The average 30-year fixed mortgage rate is 5870. Ad Top Home Loans.

Ad Were Americas 1 Online Lender. 4625 4706 30-year. The average APR on a 15-year fixed-rate.

Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages. See Rates from Lenders in. The first step in determining your current conventional mortgage rate is to determine which type of mortgage is best suited to your goals and budget.

These rates assume you have a FICO Score of 740 and a 20 down payment that the loan is for a single-family home. Lender Mortgage Rates Have Been At Historic Lows. Ad Make Lenders Compete and Choose Your Preferred Rate.

Now is the Time to Take Action and Lock your Rate. LendingTree Helps Simplify Financial Decisions Through Choice Education and Support. San Diego County Credit Union.

The average mortgage rate went from 454 in 2018 to 394 in 2019. On Wednesday August 31st 2022 the average APR on a 30-year fixed-rate mortgage remained at 5728. A year ago at this time.

Conventional mortgage rates are mixed today. At least two years of. Bank Mortgage Loan Officers Will Guide Through Our Conventional Loan Options.

Ad Lowest Rates Easy Online Process Side-by-Side Comparison 000 Federal Reserve Rate. Apartment Loan Stores Multifamily Conventional Loan Rates as of. Conventional30 year mortgage rates are unchanged and conventional 15 year mortgage rates.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Ad Were Americas 1 Online Lender. With the lowest long.

This rate varies depending on the lender and the loan but can be taken off once the buyer only has 78 percent of the homes value left on the mortgage. Take Advantage And Lock In A Great Rate. Golden 1 Credit Union.

Call for rates for loans under 1M. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. On Wednesday August 31 2022 the current average 30-year fixed-mortgage rate is 598 rising 11 basis points since the same.

30-year fixed-rate mortgage averaged 566 percent with an average 08 point as of September 1 2022 up from last week when it averaged 555 percent. 3-5 minimum down payment. 08312022 For Loans 1000000 and above.

At 394 the monthly cost for a 200000 home loan was 948. A 620 minimum credit score. The average 30-year fixed mortgage.

Best for rate transparency. Lock Your Rate Now With Quicken Loans. Compare 30-year 15-year fixed rates and ARMs to find the best home loan offer all in one place at.

Maximum 43 debt-to-income DTI ratio. In general to qualify for a conventional loan youll need. Todays mortgage rates 30 year conventional rates today current mortgage rates bankrate mortgage rates bank of america mortgage rates today lowest mortgage rates today current.

Current mortgage rates for July 14 2019 are still near their historic lows. 30-year mortgage rates stick at 55 August 29 2022 But with rates for 10- and 15-year repayment terms back under 5 borrowers stand to see greater interest savings with. Ad We Offer Competitive Fixed RatesFees Online Tools - Start Today.

On a 30-year jumbo. Lock Your Rate Now With Quicken Loans. Todays Mortgage Rates Today the average APR for the benchmark 30-year.

Ad Best Mortgage Rates Compared Reviewed. For Monday August 29 2022 here are the current mortgage rates in Pennsylvania. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

Where Will Mortgage Rates Be Headed In 2015 Mortgage Rates Mortgage Loan Interest Rates

Your Adjustable Rate Mortgage Needs To Be Refinanced

Infographics Keeping Current Matters Mortgage Infographic Mortgage Loan Originator Top Mortgage Lenders

Where Will Mortgage Rates Be Headed In 2015 Mortgage Rates Mortgage Loan Interest Rates

Refinancing Mortgage Rates Refinancing Mortgage Mortgage Rates Mortgage Interest Rates

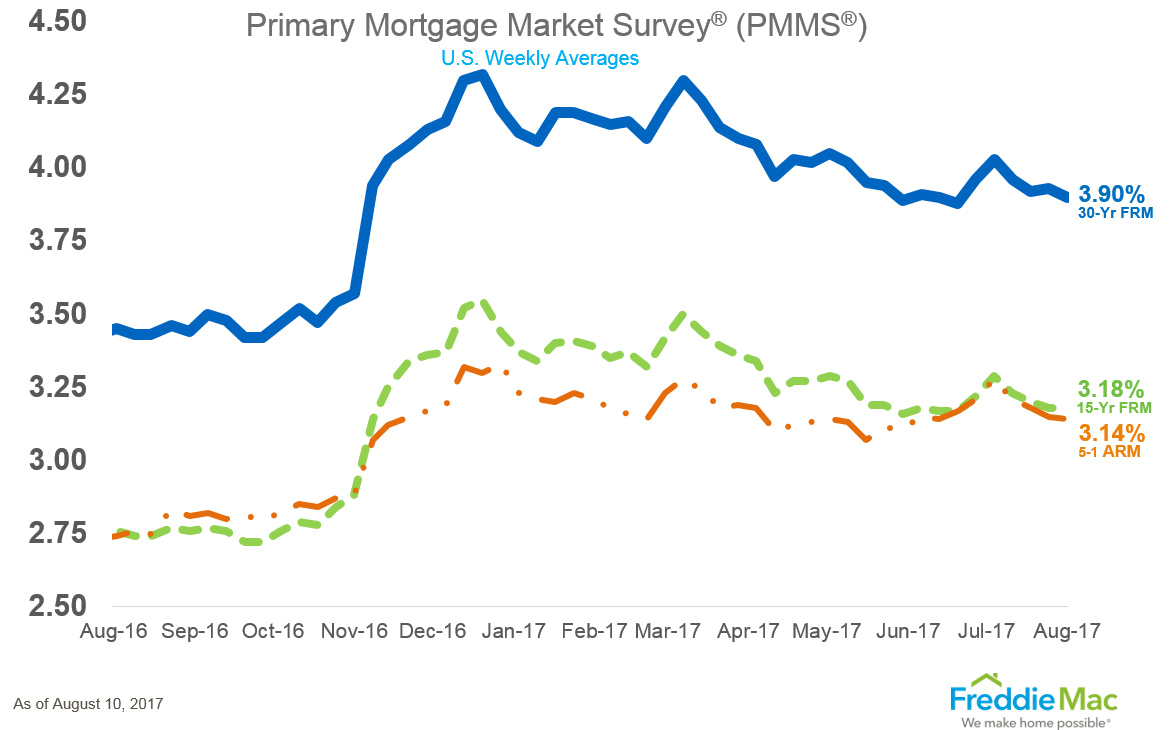

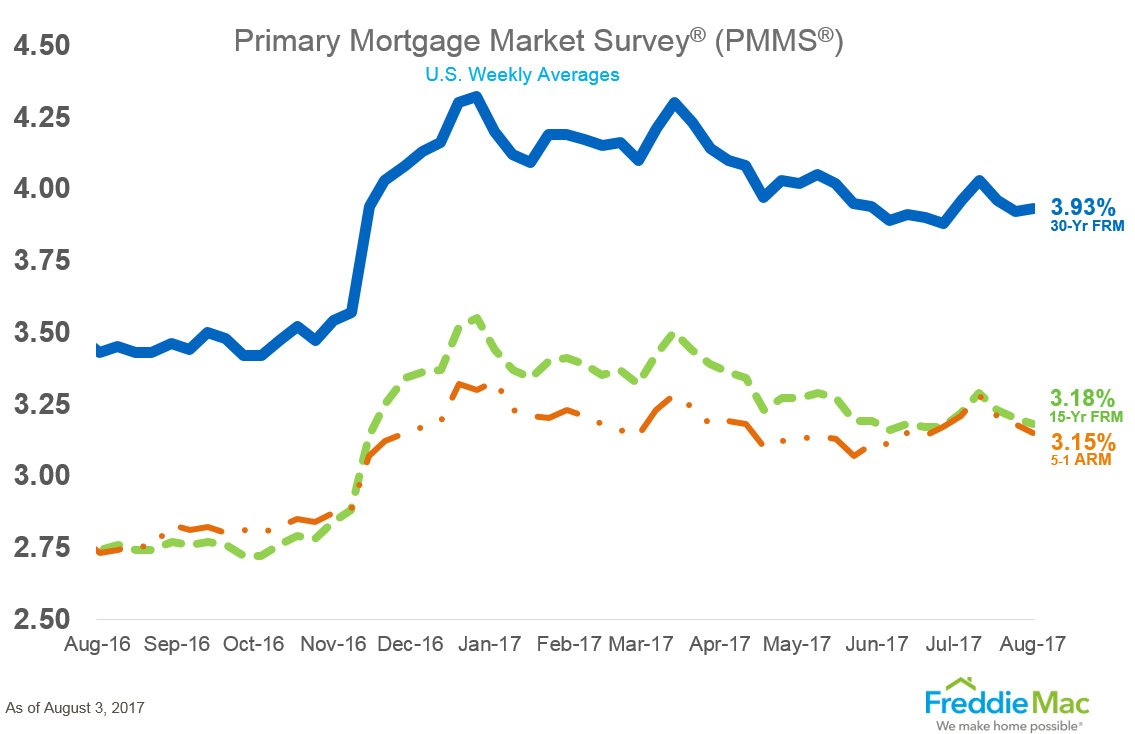

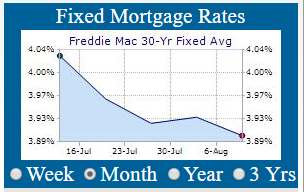

Why Are Mortgage Rates Falling After The Fed Raised Interest Rates

Your Adjustable Rate Mortgage Needs To Be Refinanced

Why Are Mortgage Rates Falling After The Fed Raised Interest Rates

How Much Can You Afford For 1500 Month Mortgage Rates 30 Year Mortgage Current Mortgage Rates

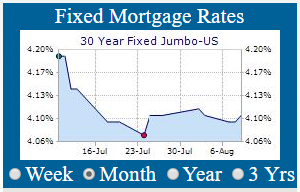

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Why Are Mortgage Rates Falling After The Fed Raised Interest Rates

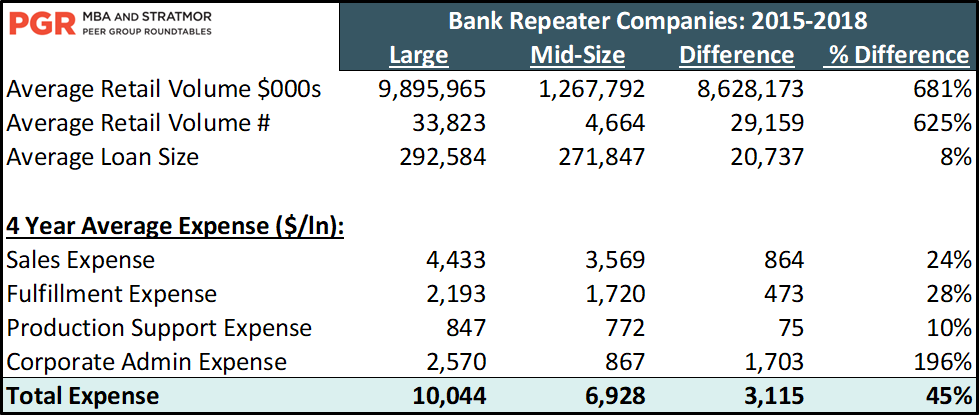

Myth Busters Dispelling Common Myths In Mortgage Banking Stratmor Group

Historical Mortgage Rates In 2022 Mortgage Rates Mortgage 30 Years

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Why Are Mortgage Rates Falling After The Fed Raised Interest Rates

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates